Posts

This provider cards shines for the convenience, getting limitless dospercent cash back on the all the orders and you can putting on a just-actually invited bonus. Ultimately, if you are not prepared to include a top-end credit card, evaluate these high beginner notes if not one to having a 0percent introductory annual percentage rate render. Since many issuers have constraints about how precisely usually you can earn a bonus on the a cards, it is important to go out the job to possess when there’s a great give.

Any time you continue a cards just after getting the benefit provide?

Once you see a deal for this card with more than 90,100000 items and you will a paying specifications that you plus short company can easily see, it is worth using. The best societal greeting provide we now have seen on this cards is actually short-lived. Inside Summer 2022, the fresh Amex Gold upped its invited give for new applicants so you can 100,100 incentive points when they spent 4,000 to your sales in the 1st six months out of card membership. The brand new Precious metal Cards out of American Show is certainly one of typically the most popular premium notes in the business, even with the steep 695 annual fee (find cost and you may charges). All the information linked to Citi checking profile could have been accumulated by the NerdWallet and has not already been analyzed otherwise provided with the fresh issuer otherwise merchant for the products.

- Ensure that the website is perfectly up to the criteria before making an account.

- Consequently, for those who currently have 5 credit cards unlock which have Western Share, then you will must intimate a card before you can become approved for a new credit.

- At this time, Synchrony’s 13-Month Video game has to offer a good cuatro.15percent APY, and the best benefit?

- Current welcome also offers, including the ones in this article, can easily hit five-hundred or even more in one credit.

- You get great bonus groups, and pros including additional leasing automobile insurance and get back defense.

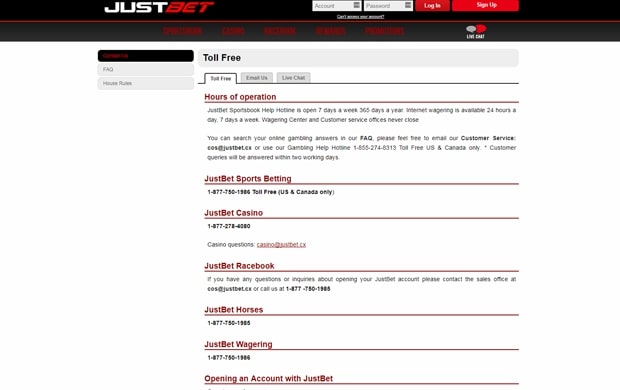

I’m interested if your bankbonus.com blog post you to says «don’t personal be the cause of half a year» are a mistake. Like most of your own national financial institutions, the costs commonly higher, however their tool breadth makes it simple in order to conveniently financial the at the one to set. As with any offer, don’t neglect to investigate conditions and terms before starting your brand-new account. It’s the spot where the financial tend to obviously condition who’s entitled to the offer in addition to people nuances you should observe away from. To get into rates and you will fees of your own Western Display Silver Card, see these pages. To access cost and you can charges of one’s Delta SkyMiles Gold Western Express Cards, discover these pages.

What are a knowledgeable credit card invited extra to you personally

Provide card, pay that have points and you can travelling or merchandise portal redemptions might have additional philosophy depending on the information on the redemption. Probably one of the most key factors out of a welcome bonus are just how much you ought to spend to be eligible for it. You should make sure to can also be achieve the spending endurance instead overspending or and then make requests you typically wouldn’t has.

For many who come to you to limitation, you’ll secure step 1percent money back to your remainder of your purchases one to season. https://mrbetlogin.com/reel-splitter/ Cardmembers afford the exact same 695 yearly payment for the Organization Platinum as the individual Rare metal (discover prices and you can fees). The present day Citi family savings incentives require that you sanctuary’t had a good Citi checking account in the last 365 months.

Factual statements about the newest Marriott Bonvoy Endless Charge card has been obtained separately from the Discover and contains maybe not started analyzed otherwise provided by the fresh issuer of your credit past so you can guide. The fresh Citi Strata Largest Cards have aggressive benefits prices and unlocks access to every one of the newest Citi ThankYou import lovers, and this boosts the property value the issues. The brand new Ink Company Well-known Credit card is fantastic small enterprises who wish to earn a lot of flexible traveling perks. The new Ink Organization Common Credit card is a great organization cards which have of use advantages, beneficial perks and you can a generous invited added bonus. The Financing You to Enjoy Dollars Perks Credit card features one of the simplest invited incentives, delivering a premier come back for a decreased investing specifications.

As the lender incentives are considered interest, when you document their taxes you’ll need statement any incentives your’ve gained. You’ll need imagine perhaps the income tax liability is definitely worth the new incentive matter. The better your mediocre monthly equilibrium around the your own connected profile (in addition to checking, certificate from deposit, IRA, discounts and several financing account) more rewards and you may professionals you’ll get at Citi. Bankrate.com try an independent, advertising-offered writer and you will analysis provider.

The mixture render will pay 900 and includes which 200 examining offer, a good 3 hundred discounts give, and you may an excellent 400 incentive to own carrying out each other. I would come across you to definitely collection just before performing both the brand new checking otherwise savings personally. I’m currently performing the benefit using them to possess 900 for we.

Chase will let you rating an advantage all the couple of years from the very last time you open a free account. If you have a primary deposit demands, Really don’t understand of every ACH import which was effective in the depending as the a primary deposit. Make an effort to thinking about using your boss or Personal Protection on the DD requirements. Manage a monthly DD otherwise keep balance in the 1500 for examining, 3 hundred to own discounts to prevent month-to-month charges. Pursue try credible to pay out incentives on time if you meet the requirements.

She is an editor and you may writer, excited about promoting enlightening content to possess clients. The woman articles are on the current financial news, especially bonuses and you may new products. Brooke has created copy for various websites, in addition to posts and you will development releases. Brooke are a scholar out of Clemson College having a diploma inside Communications and a two fold slight in the Brand Communications and you may Composing within the Mass media Knowledge. It had been sent to myself thru email address and it seems to were acquired by many people anybody else as to the I’ve been reading-in the fresh Reddit message boards. Instead of earlier Amex bank bonuses (by far the most has just ended you to definitely concluded on the Oct 8, 2022), this really is a targeted render and never folks acquired it nor is every person eligible.

Prospective downsides, according to CNBC, are month-to-month fix charge or other charge. Or, you happen to be necessary to use your debit cards otherwise shell out costs on the the brand new membership – dependent on and this financial you decide on. The new 100 percent free extra cash is being offered by the wants of Wells Fargo and you will Chase to help you award customers switching. The brand new recommendations are the expert view in our writers, rather than determined by people remuneration the website could possibly get receive out of card providers. The content is not provided by any business stated in this article. One views, analyses, recommendations or information expressed listed below are the ones from the author’s by yourself, and now have not already been analyzed, approved if not recommended by the these organization.

For those who’re also trying to open a checking account with an enormous national financial that provides online talk support and really-ranked mobile programs, Bank from The usa family savings incentives can be worth provided. If you can’t be eligible for the newest Pursue Sapphire Preferred or try not searching for the the new offer, the administrative centre One Venture Advantages Bank card is a wonderful solution. It’s the same annual payment and you may paying needs (4,100 to the credit in the 1st three months) and produces a one-time extra of 75,000 kilometers.

Have a look from the Fans Sportsbook application to see the fresh odds-on pre-race preferred Denny Hamlin, Kyle Larson and you will Ryan Blaney. Completely, the new cards today provides more than dos,700 inside annual well worth. Here is how to optimize your rewards to your Pursue Sapphire Reserve. Place a step 1 choice to the Caesars Sportsbook promo code to score (10) 100percent funds increases. Chances on the Tigers, Reds, Mets and you can Braves to victory to the Tuesday are now during the +950.